How to start the process of home buying, knowing nothing:

There are 3 big pieces you need to start focusing on: financing, credit, and preparing for your future.

Financing:

First things first you need to start saving your money if you have not already. Make a note for all the set payments monthly and yearly you have. Can you cut out any of those payments? Start to budget and pay attention to every cent that leaves your bank account. This is a great way to find out how much you can put forth within a monthly mortgage. Make sure you account for everything—utilities, food, car maintenance and payments, student debt, clothing, kids’ activities, entertainment, retirement savings, regular savings, and any miscellaneous items. It would be a great idea before buying a home to have an emergency fund, that can last you up to 6 months without you getting paid, on top of your savings account. During the home buying process there are a lot of fees including down payments and closing costs but sometimes there can be extra fees you may not know to be prepared for. It would be best to have the extra emergency fund on the side.

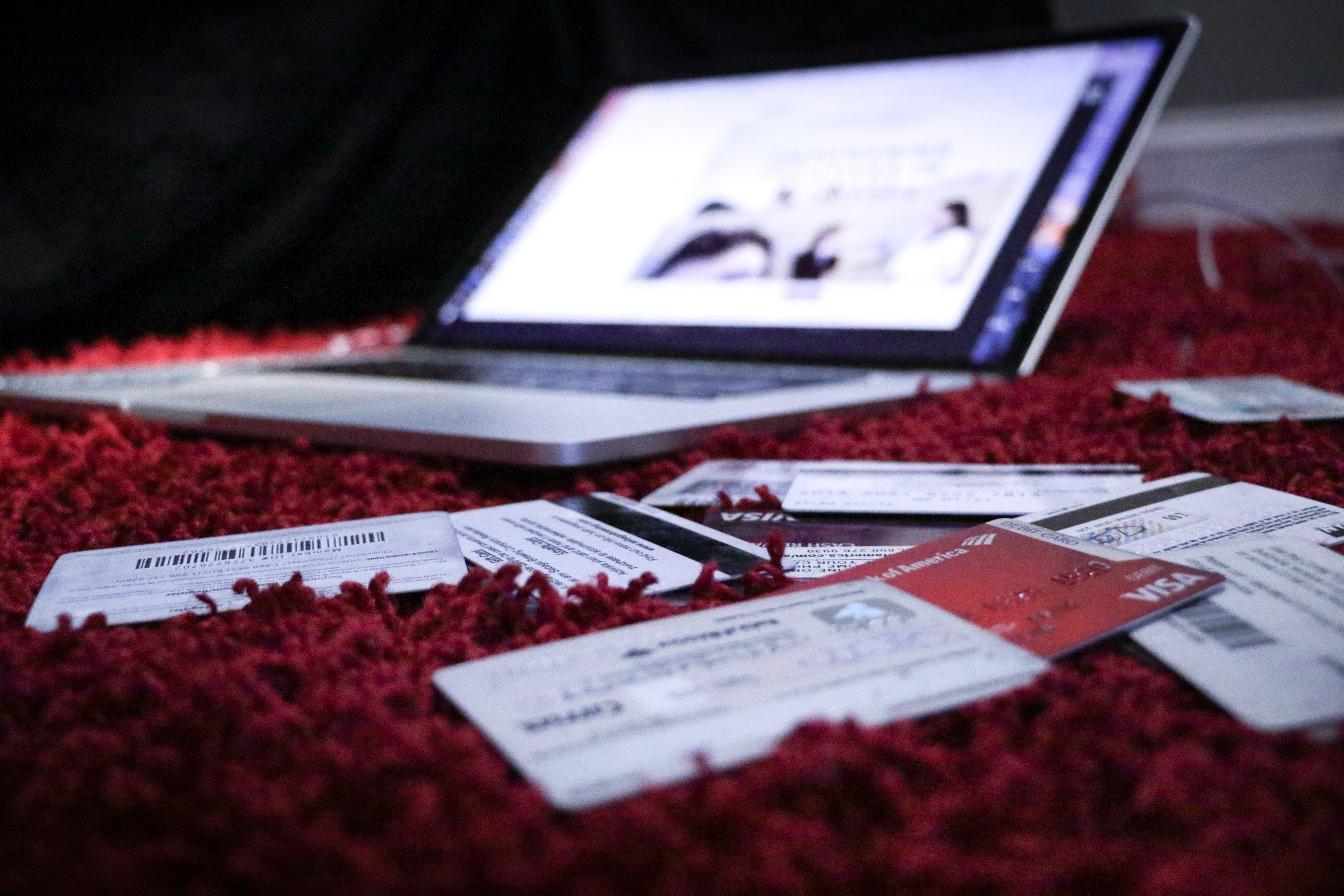

Credit:

If you do not already have a credit card. Get One. Use it every month and pay it back on time, every time. It's an easy and fast way to build your credit, just use the card and make the payments.

If you do not already have a credit card. Get One. Use it every month and pay it back on time, every time. It's an easy and fast way to build your credit, just use the card and make the payments.

If you have one, know what your score is. You need to have a good history of making all your payments on time. Most people think you need to have a 700+ credit score but there are many programs and loans you may qualify for with under 700. To start the process, know you can contact any lender or realtor with a low score or having no knowledge of how to grow your credit. We can help you get on track and start repairing your credit.

To know how much mortgage you can qualify for there are mortgage calculators that you can put your information in to find this out. Or simply reach out to a lender and they can pull your credit and talk to you about it. You have to get pre-approved before putting an offer on a home so this is a great way to start the process and know how much home you can afford.

Planning for your future:

You need to think long term when it comes to your first home. Think 3-10 years in your life. Which type of home will suit you best- condominium,

townhouse, duplex, or multi unit. Every home has its pros and cons. It all depends on your lifestyle and area you would like to be in.

What kind of home features are must-haves and wants in your first home? While remaining relatively flexible in this category this will be the biggest purchase of your life, thus far, you want it to fit you and be within reach.

You're most certainly not going to be alone in this process. Get a great real estate agent on your side. You'll sit and talk with your agent and let them know everything- if you have a lender(to know how much you can afford), what your wants and needs are in your home, and the location you want to look in. Once you find that perfect home your agent will walk you through the offer, negotiating process, and all the paperwork. They look at this transaction as if it were them buying the house, they have nothing but your best interests to get you your desires. Try not to be discouraged if you can't get that first home, it happens to the best of us, just stay positive and keep looking, there is a better home for you down the road! The best part about a real estate agent is that they are compensated by the seller. All the great benefits from an agent are free to you!

To put into basic terms the home buying process goes:

Talk to a lender, get pre-approved and secure financing

Find a realtor

Find a home

Make an offer and get accepted

Have the inspections and appraisal

Close and move in